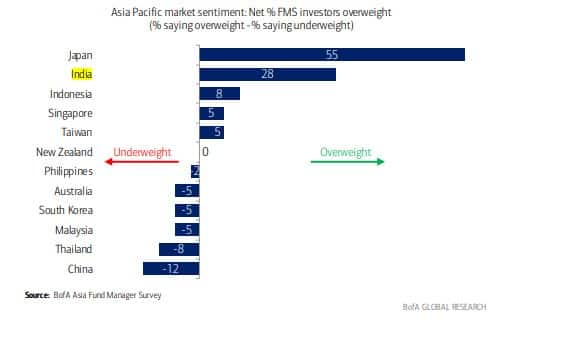

Japan is the favourite and Indonesia comes a far third, and a considerable share of fund managers are bracing for a weaker global economy

October 18, 2023 / 01:27 PM IST

Investors are taking stock of of higher rates, stronger dollar and flare-ups in oil prices.

India is the second-favourite among fund managers in Asia, with 28 percent being ‘overweight’ on the country and 55 percent on Japan, according to a survey by BofA Global Research.

The percentage is a net of those who are ‘overweight’ on a country, which is the difference between the percentage of managers saying ‘overweight’ and those being ‘underweight’.

Indonesia has come a far third with only 8 percent fund managers being ‘overweight’ on the country, and the fourth spot has gone to Singapore, while Taiwan has bagged 5 percent ‘overweight’.

Also read: Fund flows decline much after continuous stock price fall: Prashant Khemka

Among the investing themes in favour and those losing favour, the report said, “The FMS (fund manager survey) continues to nurture a positive stance on the semiconductor cycle, with net 52 percent expecting it to gather strength in the next 12 months. Accordingly, semis (cited by net 32 percent of investors) are perched at the top of the investor pecking order, not just in the region, but within China, too. On the other hand, bond proxies (utilities: net 22 percent underweight; real estate: net 18 percent underweight) and materials (20 percent) are out of favour.”

Overall, though an overwhelming number does not believe that there will be a hard landing from the central banks trying to tame inflation, the fund managers’ outlook for the global economy is still “tepid at best” — a net 50 percent of the survey participants are bracing for a weaker economy in the next 12 months.

The report added that the sentiment in the Asia survey has also mellowed down with only a net 15 percent expecting a stronger economy in the next 12 months, which is a significant fall from the net 39 percent in August.

The analysts noted that this is from investors taking stock of of higher rates, stronger dollar and flare-ups in oil prices. “The silver lining is that stagflation is not being projected either, as net 23 percent of investors expect price rises in Asia to subside in the next 12 months – a lowest decile reading,” it said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!