Synopsis

An OFS involves the sale of existing shares by large stakeholders, such as promoters, venture capitalists or institutional investors. The funds from an OFS go directly to the selling shareholders rather than the company itself.

ETtech

ETtechGhazal Alagh, cofounder and CIO, Honasa Consumer — the parent company of beauty and personal care brand Mamaearth — clarified a query on social media platform X (formerly Twitter) about the high amount of the offer for sale (OFS) component in the company’s initial public offering (IPO).

Responding to a question from a user, Alagh pointed out three reasons behind the company’s rationale, “Largest investor is not selling a single share; promoters are holding 97% of their ownership in company; and whoever is selling in OFS is also holding more than they are selling (one needs to build a minimum pool for IPO size and cash generating companies need limited primary capital).”

Elevate Your Tech Prowess with High-Value Skill Courses

| Offering College | Course | Website |

|---|---|---|

| IIM Lucknow | IIML Executive Programme in FinTech, Banking & Applied Risk Management | Visit |

| Indian School of Business | ISB Professional Certificate in Product Management | Visit |

| IIT Delhi | IITD Certificate Programme in Data Science & Machine Learning | Visit |

An OFS involves the sale of existing shares by large stakeholders, such as promoters, venture capitalists or institutional investors. The funds generated from the sale in an OFS go directly to the selling shareholders rather than the company itself.

Also read | IPO-bound Honasa says its growth will build on flagship Mamaearth

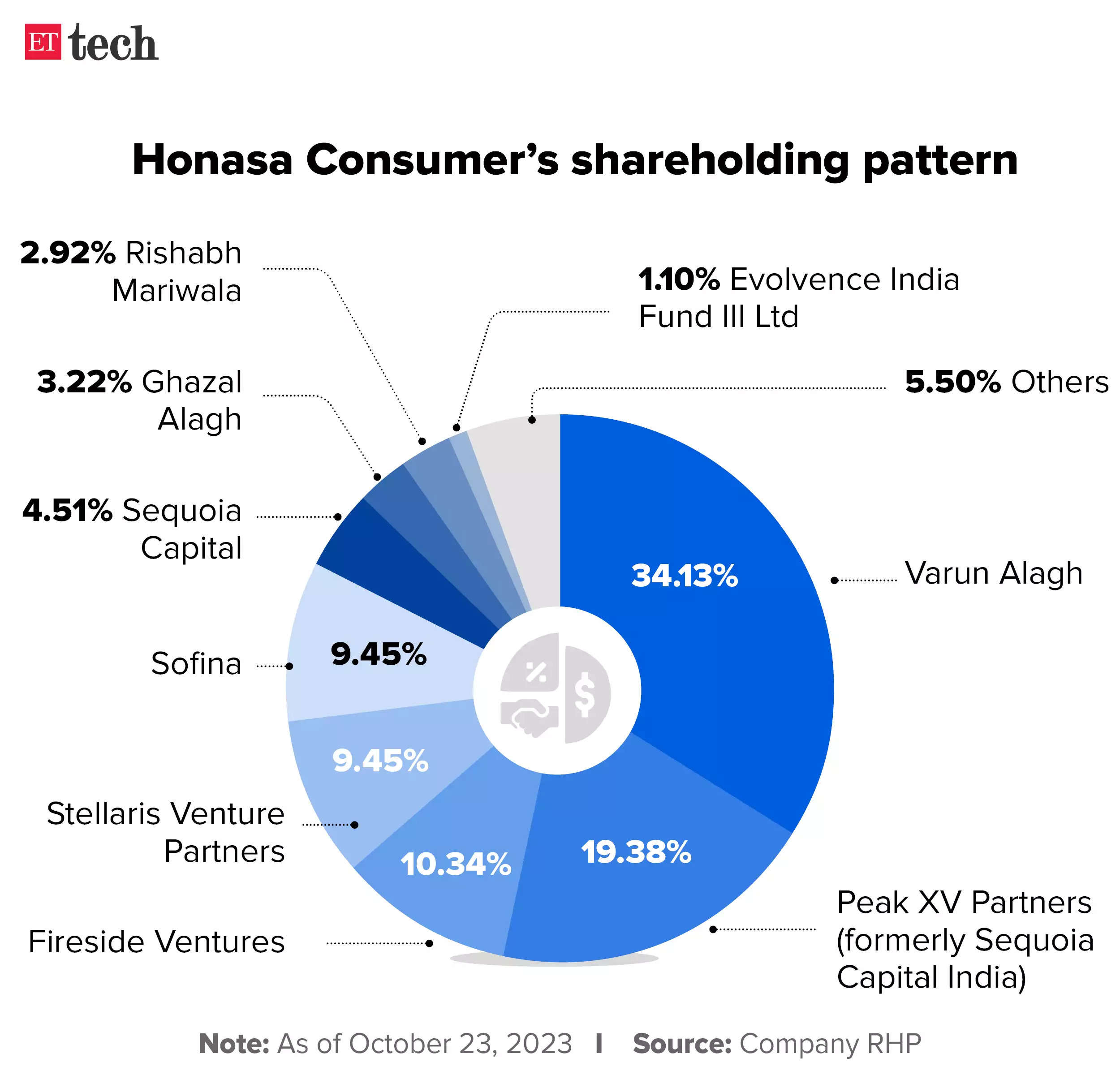

The IPO includes a fresh equity issue of Rs 365 crore and an offer for sale of about 4.12 crore shares. Under the OFS, founders Varun Alagh and Ghazal Alagh along with investors Kunal Bahl, Shilpa Shetty Kundra, Rishabh Mariwala will offload partial stakes. Peak XV Partners is the largest shareholder in Honasa, with a 19.38% stake.

ETtech

ETtechHonasa Consumer raised Rs 765.19 crore from 49 anchor investors ahead of its initial public offering (IPO) launch on Tuesday. The company has also allocated shares worth Rs 253.61 crore to domestic mutual funds.

Also read | Personal care brand Mamaearth gets set for renewed overseas push

The IPO will close on November 2. Mamaearth has fixed a price band of Rs 308-324 per share for the offer. At the upper end of the price band, the company is valued at Rs 10,425 crore and is planning to raise Rs 1,701 crore through the offer.

Also read | Mamaearth parent says contribution of top 10 products to operating revenue decreasing

Read More News on

Stay on top of technology and startup news that matters. Subscribe to our daily newsletter for the latest and must-read tech news, delivered straight to your inbox.

…moreless