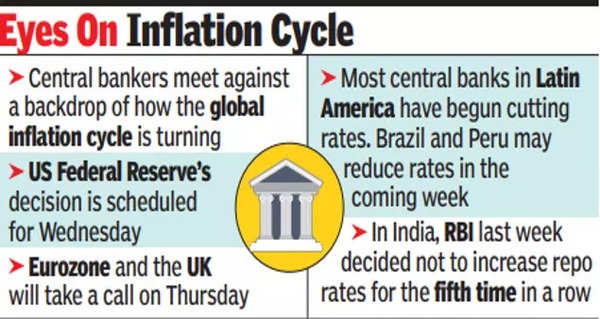

From Washington to Frankfurt to London and beyond, central bankers are approaching their final decisions of the year against a backdrop of unease at how the global

inflation cycle

is turning.

Policymakers from fully half of the Group of 10 jurisdictions of most-traded currencies are scheduled to meet in the coming days, and interest rates for 60% of the world economy will be set in a whirlwind 60-hour window.

Most notable will be the

US Federal Reserve

on Wednesday, followed on Thursday by central banks including those of the eurozone and the UK.

With the exception of Norway — which may conceivably raise borrowing costs — most monetary officials are confronting financial-market pressures to explain why they seem unhurried about pivoting to monetary easing.

Synchronised weakening in inflation data and some evidence of softening economies have prompted investors to ramp up bets on rate cuts in the first half of 2024. That’s a view that could clash with the mantra the Fed and its peers expounded little more than three months ago, of “higher for longer”.

In Latin America, which led the push upwards with rate hikes, most central banks are already on the way down, and Brazil and Peru may both cut in the coming week.