After scooters, electric buses are India’s next big focus when it comes to accelerating the country’s slow shift to cleaner transport.

Auto manufacturers are getting on board. Ashok Leyland Ltd., the flagship company of conglomerate Hinduja Group, broke ground last month on a manufacturing plant for electric commercial vehicles in the northern state of Uttar Pradesh. The Chennai-based firm says the facility will have an initial capacity of 2,500 vehicles with production climbing to 5,000 annually over the next decade. It should be ready to start operations by the end of 2025.

“The primary focus will be on the production of electric buses, while also having the capability to produce other vehicles powered by existing and other emerging alternate fuels,” Ashok Leyland Chief Executive Officer Shenu Agarwal said. “We will make products for both Ashok Leyland and Switch Mobility from this plant,” he added, with reference to Ashok Leyland’s EV arm.

Tata Motors Ltd. unit TML Smart City Mobility Solutions, meanwhile, expects to deploy 3,300 e-buses on roads by fiscal 2025, and Olectra Greentech Ltd., which has a partnership with China’s BYD Co., is constructing a new e-bus plant that’s forecast to start production in July, according to local media. It intends to deliver at least 2,500 e-buses by fiscal 2025.

India has set a target of adding 50,000 e-buses to its roads by 2027 as it seeks to reach net zero carbon emissions by 2070. It’s a tall order considering the majority of the country’s fleet of 1.5 million buses run on diesel.

Bloomberg

BloombergArguably the biggest roadblock in increasing the uptake of e-buses is the lack of financing. India currently follows a model whereby state agencies tender for buses from automakers but the operation of the vehicles, and any setting up of charging infrastructure, remains the responsibility of the auto manufacturers. Cash-strapped state entities have missed payments to automakers in the past, deterring them from bidding for bus tenders.

“The real challenge is the financial model given state transport units aren’t financially strong,” said Kavan Mukhtyar, partner and leader, automotive, at PwC India. “All the risk falls on private companies.”

To tackle this, India has enlisted the help of the US in establishing a payment-security fund to cover the procurement of as many as 38,000 e-buses. India will contribute $240 million and the US government $150 million and the fund will serve as a guarantee against any delayed payments from state entities.

In India’s push to go green, it’s crucial authorities get this right.

Public transport is key in curbing vehicle emissions in India — home to cities that have some of the most polluted air in the world. It will also help with traffic congestion and travel times, especially in big centers. Jams have become worse over the years with millions of people relying heavily on two-wheelers to get about due to a lack of efficient public transport.

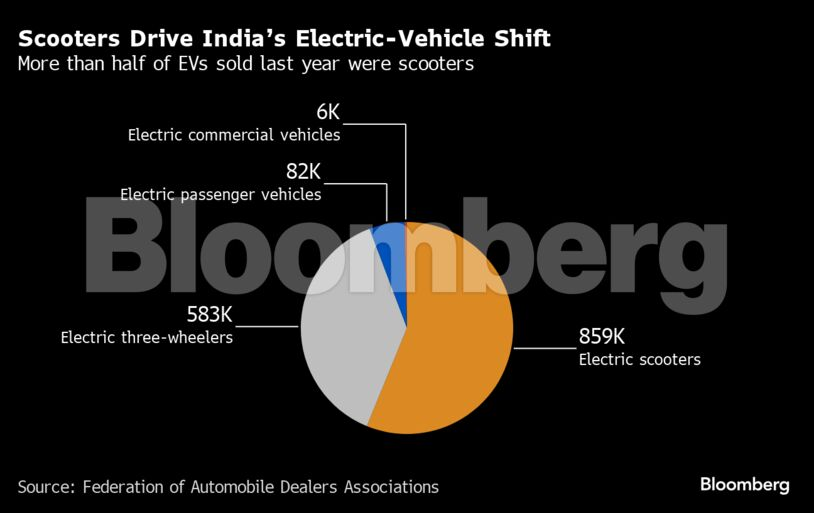

Currently, however, it’s scooters leading electrification in India’s price-sensitive market due to their cheaper upfront cost than cars. Only 5,670 electric commercial vehicles were sold last year, although that was up 114% from 2022.

“There’s naturally a bigger focus around electrifying public transportation,” said Rahul Mishra, a partner at management consultancy firm Kearney. “Given that most of the commercial vehicles run a larger number of kilometers, the savings on tailpipe emissions is higher and the cost economics tends to be much better.”

PwC’s Mukhtyar added that constraints around charging infrastructure are relatively solvable when it comes to e-buses because they operate on a fixed route and so charging infrastructure can just be placed at a depot. But private companies need to be supported through regulatory means like tax breaks, incentives and soft loans, considering electrification of buses is capital intensive, he said.

“The main agenda should be to switch to e-buses in the top 20 Indian cities where pollution is such a big issue,” Mukhtyar said. “It’s a program that needs to be prioritized.”