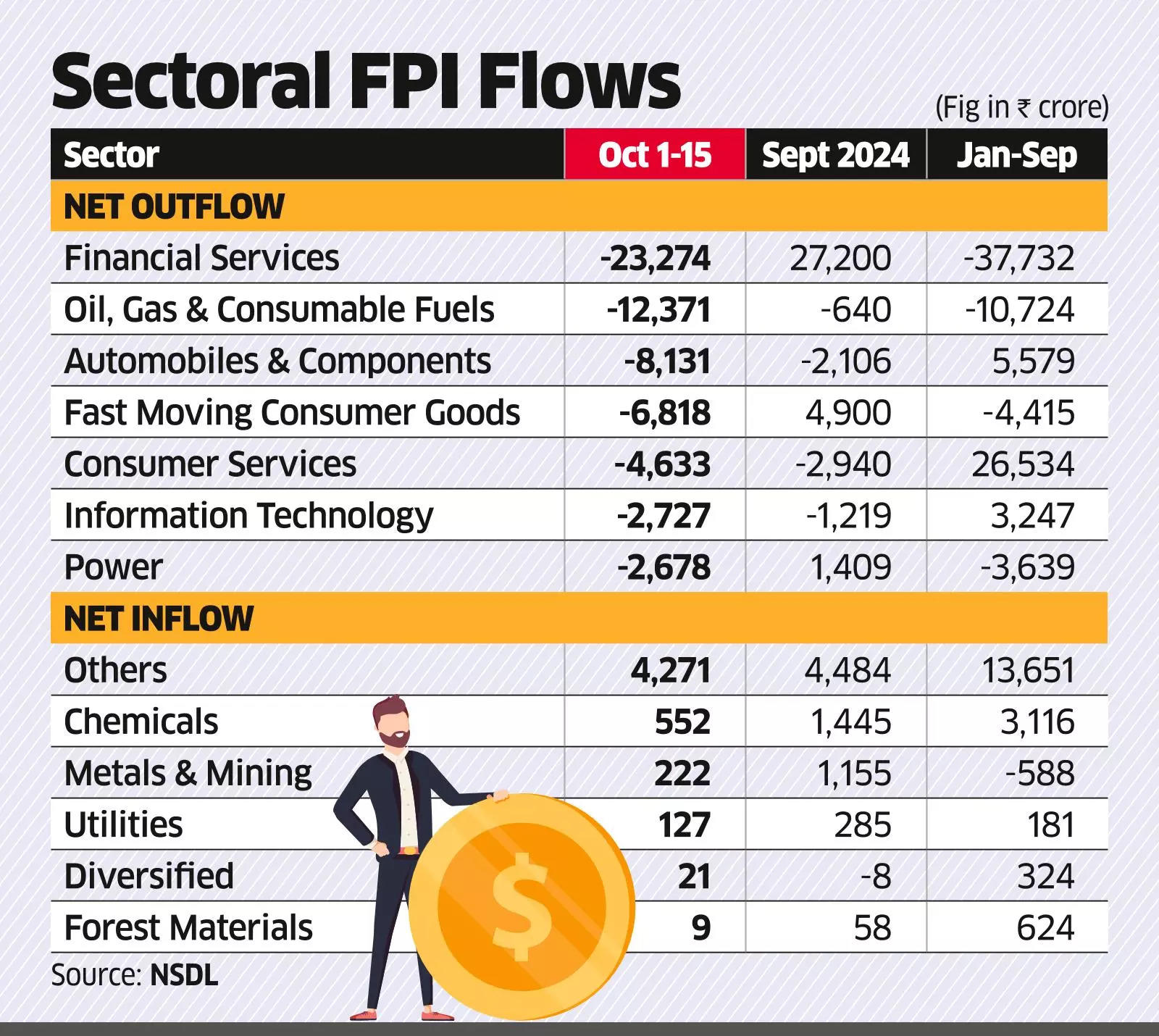

Mumbai: Overseas investors sold Indian equities worth ₹71,502 crore across 17 sectors in the first 15 days of October, according to data from NSDL.

Financial services bore the biggest brunt of foreign selling, with investors pulling ₹23,274 crore out of these shares after buying a similar amount in September. From January to September, overseas investors sold ₹37,732 crore in the sector.

Since financials form a large portion of the Nifty 50‘s weight (33%), shares of sectoral players are sold off the most by foreign portfolio investors (FPIs) in the event of a risk-off sentiment.

“The fact that the second-quarter results for financials could be under pressure due to scramble for deposits and heightened competition would also have weighed on the minds of FPIs,” said Dhiraj Relli, CEO of HDFC Securities.

Bank Nifty fell 3.2% in the past month while the benchmark Nifty 50 tumbled 3.6% in the same period.

“Foreign investors have a huge holding in financials and this time around they sold across baskets. However, the sector has witnessed a similar amount of inflows in September which indicates that they might have squared off their recent positions,” said Hemant Nahata, co-lead for strategy at Yes Securities.

Foreign investors have pulled ₹77,000 crore out of Indian equities so far this month (as of October 18) – their highest selling in a month in recent years – as a rebound in Chinese equities has lowered their appetite for local stocks.

Oil & gas and power sectors were the other themes that witnessed higher foreign outflows in this period. While oil & gas shares saw selling worth ₹12,371 crore primarily due to the uptick in crude oil which rallied to $81.13 per barrel earlier this month on account of the conflict in West Asia, power sector shares witnessed outflows to the tune of ₹2,678 crore.

“Apart from being a heavyweight on the benchmark index, Reliance is a heavyweight within the oil & gas sector since FPIs have no major holdings in the other PSU names,” said Nahata. “The recent selling in the oil & gas space could be largely due to FPIs selling in Reliance Industries.”

The incessant foreign selling extended to defensive sectors such as fast-moving consumer goods (FMCG) and healthcare, which had received foreign inflows in September. Foreign investors offloaded shares worth ₹6,818 crore from FMCG stocks and ₹2,376 crore from healthcare stocks in the first half of October.

As sentiments toward Indian markets have turned mildly negative from the FPI side due to valuation concerns, they have been aggressive sellers, said Relli.

“So even defensives like healthcare and FMCG have come under selling pressure as their valuations continue to be on the higher side,” he said.

Construction, telecommunications and construction materials were among the sectors which saw a reversal of trend with overseas investors turning sellers worth over ₹1,000 crore in the first fortnight of October.

Overseas investors infused ₹5,202 crore into six sectors in the first half of the month. The sector earmarked as ‘others’ received the highest inflows worth ₹4,271 crore while chemicals and metals & mining received ₹552 crore and ₹222 crore, respectively.

“FPIs still have major holdings in Indian equities, further selling cannot be ruled out albeit at a slower pace as markets have corrected,” said Nahata.

“The selling in India was initially triggered due to the China-India trade-off but the earnings disappointment by consumption-based names are further dampening the sentiment.”

Relli said that as the selling is India-market specific, all sectors could face selling pressure in proportion to the holding by FPIs. However, sectors like IT, power and real estate could see lower selling pressure than others.