MUMBAI: The sensex, for the third consecutive session, closed at a new high, boosted by improved investor sentiment from the prospects of continuity of the current BJP-led government at the Centre post Lok Sabha polls in 2024. On the NSE, the

nifty

too closed at a new high for the fourth consecutive session.

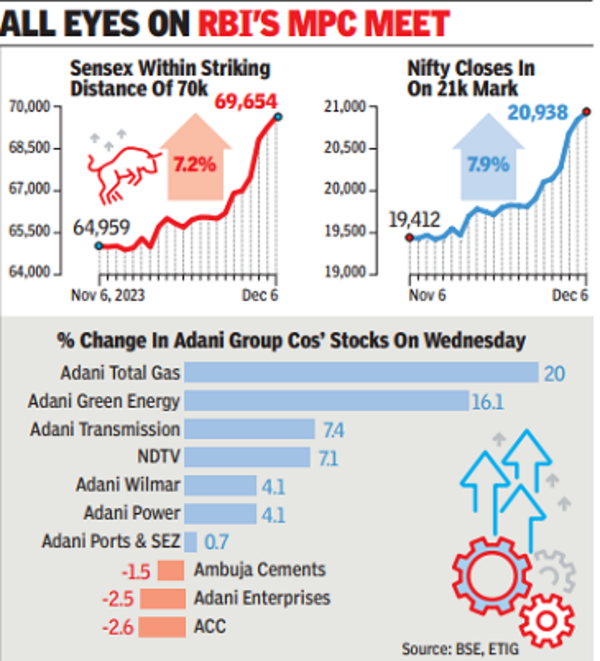

The sensex rallied to an all-time high at 69,745 points and closed at 69,654 points, up 358 points on the day, while nifty touched a new life high at 20,962 points and closed at 20,938 points, up 83 points.

According to Prashanth Tapse, senior VP (Research), Mehta Equities, the winning streak for the leading indices continued on Wednesday as Dalal Street is now anticipating a strong popular mandate for the BJP in the upcoming 2024 Lok Sabha polls. “Also, falling crude oil prices and hopes that the US Federal Reserve will initiate rate cuts in the coming year, boosted investors’ confidence,” he said.

The day’s rally was supported mainly by domestic funds with a net inflow of Rs 1,372 crore, while foreign investors were net sellers at Rs 80 crore,

BSE

data showed. It was the first trading session since November 23 that foreign funds turned net sellers in the stock market, CDSL data showed.

Day’s gains added Rs 2.4 lakh crore to investors’ wealth with BSE’s market capitalisation now at Rs 355.6 lakh crore, translating to $4.3 trillion, an all-time high mark. Among the sensex stocks, ITC, L&T, Reliance Industries, TCS and Infosys contributed the most to the day’s gain, while selling in ICICI Bank, Axis Bank and NTPC restricted the gains, BSE data showed.

Going forward, with RBI’s rate setting committee meeting set to announce its decision Friday, all eyes will be on the same, though most expect the central bank to stay put on interest rates at the current levels. In such a situation, “investors will focus on the RBI governor’s commentary and clue for rate cut,” said Siddhartha Khemka, head – retail research, Motilal Oswal Financial Services. “Rate sensitive sectors will remain in focus” for the next two sessions at least, he said.