Updated – September 28, 2023 at 09:54 PM.

|

Mumbai

Card additions for the month remained healthy, increasing by 1.6 per cent on-month compared with 1.3 per cent in July

As per the data, 64.4 per cent of the credit card spends during August were for e-commerce payments, a fall from 65.7 per cent last month

| Photo Credit:

2Ban

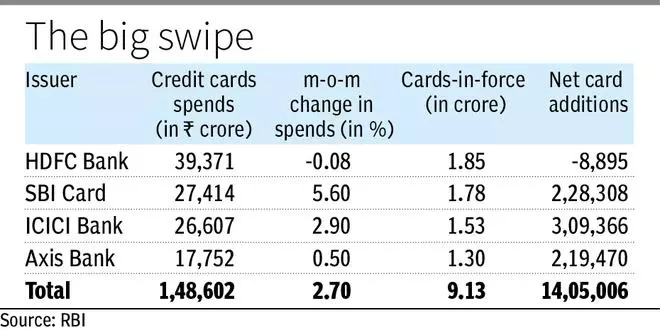

Credit cards-in-force crossed the 9-crore mark in August to touch a high of 9.13 crore cards outstanding as at the end of August, according to data by the Reserve Bank of India.

Card additions for the month remained healthy, increasing by 1.6 per cent on-month compared with 1.3 per cent in July. The industry net added 14.1 lakh cards during the month, higher than 11.9 lakh cards in July. The increase in cards was also higher than the earlier peak of net additions of over 12 lakh credit cards seen in April and May.

Credit cards-in-force as of March 2023 had stood at 8.5 crore, up 15.9 per cent for FY23.

Among the top issuers, ICICI Bank was the leader in terms of the increase in number of cards, net adding 3.09 lakh cards during the month to a total of 1.53 crore cards. In July, the bank had net added 1.86 lakh credit cards.

Largest card issuer

HDFC continued to maintain its position as the largest card issuer with cards-in-force at 1.85 crore, despite seeing a net decline of 8,895 cards during the month. Both State Bank of India and Axis Bank saw net additions of over 2 lakh cards each.

Kotak Bank, RBL Bank and YES Bank were the other top issuers to see strong net additions of cards during the month.

Card spends

On the spends side too, credit cards continued to set a fresh record, with spends growing 2.7 per cent to ₹1.48-lakh crore in August from ₹1.45-lakh crore in the previous month. Most major issuers, barring HDFC Bank, registered an increase in spends during the month.

As per the data, 64.4 per cent of the credit card spends during August were for e-commerce payments, a fall from 65.7 per cent last month. On the other hand, the share of PoS (point-of-sale) transactions rose to to 35.6 per cent from 34.3 per cent in July.

SBI, which passed ICICI Bank, in terms of monthly card spends in June, saw the highest increase in spends. The issuer retained its second spot, with spends growing 5.6 per cent to ₹27,414 crore.

ICICI Bank saw spends increase by 2.9 per cent, and Axis Bank by a mere 0.5 per cent. Spends for HDFC Bank fell a marginal 0.08 per cent on month, in spite of which the lender continued to lead in terms of spends, which stood at ₹39,371 for the month.

Other large issuers such as IndusInd Bank, RBL Bank, Kotak Bank and American Express too saw healthy credit card spends in August. Monthly credit card spends crossed the ₹1-lakh crore mark nearly 1.5 years ago. Total credit cards spends for FY23 were ₹14.3-lakh crore, 47 per cent higher on year.